There are lots of good reasons to make a deal at the final table of a poker tournament. The biggest reason is if you want to secure a specific prize amount.

- Some players prefer to deal at smaller final tables to save time.

- Then sometimes the deal is just so good you cannot say no to it.

Probably the best long-term reason to get used to dealing is to reduce variance. If you are a serious MTT grinder, you know that the big final tables only come around a few times a year.

Probably the best long-term reason to get used to dealing is to reduce variance. If you are a serious MTT grinder, you know that the big final tables only come around a few times a year.

How they go is often the deciding factor in how profitable that year was.

I have just co-written a new book with Dara O’Kearney called Endgame Poker Strategy: The ICM Book.

In it, we look at all the aspects of the end stage of poker tournaments that impact your bottom line, such as the following:

1. Especially how you play on bubbles

2. Your overall play at final tables

3. When making final table deals

Your most significant money decisions are ICM decisions. Your decision to deal might be the biggest one of your poker year.

How Much Is that Final Table Deal Worth?

Let’s look at a hypothetical example. Say we are at the final table of the $1 million GTD Big Shot that took place at 888poker this September. It was a $109 MTT that attracted 8,602 entries.

Let’s say we have got to the five-handed stage, and a deal has been suggested. This feature is something you can do at 888poker final tables directly from the client.

We will assume one player has 2 million chips, the next has 1.5 million chips and a 3rd player 1 million chips. The 4th shortest has 500,000 chips, and the short stack has 200,000 chips.

Below is a table with the actual payouts from that tournament and the ICM value of each stack. This chart shows what each player would get if they did an ICM deal using the 888poker deal feature:

|

Player |

Chips |

Potential Payout |

ICM Value |

|

1 |

2,000,000 |

$122,000 |

$93,936.65 |

|

2 |

1,500,000 |

$90,000 |

$87,301.61 |

|

3 |

1,000,000 |

$70,000 |

$78,107.12 |

|

4 |

500,000 |

$53,000 |

$63,567.75 |

|

5 |

200,000 |

$36,000 |

$48,068.88 |

If you have never done an ICM deal before, the numbers may surprise you, most notably Player 1 and Player 5.

Chip leaders are rarely happy with the amount offered in an ICM deal because they are the most likely to win the tournament.

Short stacks will usually bite your hand off to take an ICM deal when they see it. They are surprised by how valuable a small stack can be.

Let’s say Seat 3 is a professional online player who plays 10,000 tournaments a year with an average buy-in of $40. They satellited into this event. That means, on an average year, they make $80,000.

Should they accept the $78,107.12 offered to them, or should they ‘play for the win’ and try to win the $122,000 first prize?

Most of the time, that deal would work out badly for them.

How Accepting a Deal Affects Your Results

Don’t think they are still playing a $109 MTT and should be happy with the result regardless. Think of this like it’s a new tournament where the following is the case:

- They are investing $42,107.12 (their current equity $78,107.12 minus the 5th place prize they are guaranteed $36K)

- To win a potential first prize of $86,000 ($122,000 minus the guaranteed $36k)

Would that person be wise to play a single table tournament for $42k just to win $86k? It would be a terrible decision, especially in the context of $80,000 representing an average year’s earnings.

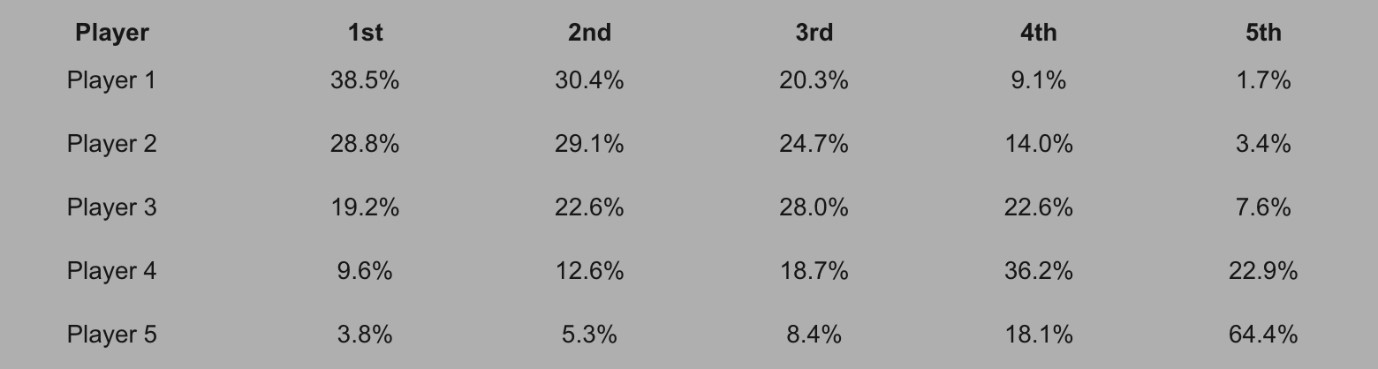

If that hasn’t convinced you, let’s take a look at how often each player wins when the tournament continues.

Below is a distribution of finish positions for each player:

You can do this yourself at www.primdedope.com.

The chances of each player coming 1st are just their percentage of the chips in play. But for every other position, it gets more complicated.

If Player 3 didn’t deal, they’d win 19.2% of the time and come 2nd 22.6% of the time. The rest of the time, they would have been financially better off having dealt. The ICM value of their stack was $8,107.12 more than 3rd place.

Much more than half the time, they would have been better off dealing. Remember, this is a massive field final table. They do not come around very often.

Would you be happy taking a worse than a coinflip shot at doing better than the deal offered?

When To Do and Not To Do a Final Table Deal

There are plenty of good reasons to do and not to deal a final table deal:

- When NOT TO DO

If you believe you have a significant edge over the remaining players in the field. ICM calculations do not factor in any edge. They assume people are equally skilled, which isn’t a terrible starting point because edges are small at the final table.

- When TO DO

When it comes to the bigger final tables, most players will be better off dealing. They should consider locking up an amount that can change the course of their career rather than risking a lot of equity in a high variance spot.

The equity figures and considerations we have highlighted above do not just impact deals. ICM affects every aspect of your decision making, especially at the late stages of a tournament where the money matters.

Your most significant poker decisions will all be ICM decisions, which is why we wrote Endgame Poker Strategy to help you navigate through them.

***********

Barry Carter is the co-author of Endgame Poker Strategy: The ICM Book, the first book to take a deep dive into the subject of ICM in multi-table tournaments.